Tuesday, August 30, 2011

September is Life Insurance Awareness Month!

Life insurance can do some pretty amazing things for people. It can buy loved ones time to grieve. It can pay off debts and loans, providing surviving family members with the chance to move on with a clean slate. It can keep families in their homes and pre-fund a child’s college education. It can keep a family business in the family. It can provide a stream of income for a family to live on for a period of time. Life insurance can do all of these wonderful things for your family…there’s just one small catch. You need to own life insurance.

There’s a growing crisis of too many Americans not having adequate life insurance protection. According to the industry research group LIMRA, 30 percent of US households have no life insurance whatsoever. Today there are 11 million fewer American households covered by life insurance compared with six years ago. Here’s the bottom line: A majority of families either have no life insurance or not enough, leaving them one accident or terminal illness away from a financial catastrophe for their loved ones.

What if you were suddenly gone and your family had to manage on their own? When was the last time you did the math to make sure your loved ones would be OK financially? Have you checked with your employer to find out what kind of life insurance benefit you have through work and whether you have the option to increase your coverage? When was the last time you had your life insurance needs reviewed by an insurance professional?

To make sure Americans are reminded of the need to include life insurance in their financial plans, the nonprofit LIFE Foundation coordinates Life Insurance Awareness Month. Each September, LIFE is joined in this educational initiative by more than 100 of the nation’s leading insurance companies and industry groups. LIFE’s website is the leading source of objective information about life insurance. Spend a few minutes learning more and trying our interactive tools like the Life Insurance Needs Calculator. If you find that you have a need for coverage, we strongly urge you to act by contacting an insurance professional in your community or your benefits manager at work. Your family’s financial future is too important to leave to chance.

There’s a growing crisis of too many Americans not having adequate life insurance protection. According to the industry research group LIMRA, 30 percent of US households have no life insurance whatsoever. Today there are 11 million fewer American households covered by life insurance compared with six years ago. Here’s the bottom line: A majority of families either have no life insurance or not enough, leaving them one accident or terminal illness away from a financial catastrophe for their loved ones.

What if you were suddenly gone and your family had to manage on their own? When was the last time you did the math to make sure your loved ones would be OK financially? Have you checked with your employer to find out what kind of life insurance benefit you have through work and whether you have the option to increase your coverage? When was the last time you had your life insurance needs reviewed by an insurance professional?

To make sure Americans are reminded of the need to include life insurance in their financial plans, the nonprofit LIFE Foundation coordinates Life Insurance Awareness Month. Each September, LIFE is joined in this educational initiative by more than 100 of the nation’s leading insurance companies and industry groups. LIFE’s website is the leading source of objective information about life insurance. Spend a few minutes learning more and trying our interactive tools like the Life Insurance Needs Calculator. If you find that you have a need for coverage, we strongly urge you to act by contacting an insurance professional in your community or your benefits manager at work. Your family’s financial future is too important to leave to chance.

Saturday, August 20, 2011

Whole Life Insurance: The New Asset Class

Whole Life Insurance: The New Asset Class

November 17th, 2009 // 12:10 pm @ Andrew Rosenbaum

- They embody a future benefit that involves a capacity to contribute to and receive future net cash flows.

- They involve a resource controlled by a firm or an individual that offer the possibility from which future economic benefits (besides cash) are expected to flow.

- They allow the owning entity control and access to the benefit.

I liken the performance of permanent life insurance to that of an investment-grade bond with a super-bonus.

The word “bond” works well here because a bond is a financial instrument that is very stable, reliably producing low-risk gain. It doesn’t offer crazy, off-the-chart returns; just safe reliable actual rates of return.

The super-bonus is the death benefit, which is payable income-tax free to the policyholder’s chosen beneficiary. More importantly, with the right strategies the death benefit can be leveraged by the policyholder to use while living.

When used this way (which I discuss in the next chapter), whole life insurance is an asset class of substantial value that meets all the designated criteria:

- The cash value provides the policyholder with living benefits similar to a fixed account with a guaranteed minimum return that can be used for a wide range of applications.

- The death benefit provides cash when needed most.

- The tax-deferred cash accumulation can be accessed income-tax free.

- The death benefit is payable income-tax fee and, with the proper strategies, estate-tax free.

- Policy proceeds are typically beyond the reach of creditors.

- Unlike equities, with a waiver of premium rider, the policy is self-completing in the event of disability.

- The death benefit is based on the event of death — not a market event that can cause a downturn in value.

- Premiums may be funded with interest earned from other invested assets in lieu of budgeted income.

- Adding permanent life insurance to a portfolio of cash, bonds and equities can produce at least as favorable long-term result with less risk then a similar portfolio without life insurance.

Because of these factors, I view permanent life insurance as an unknown new asset class. It is even more appealing in that it still flies under the radar screen of the federal government’s tax-claw.

Here’s another example of a tax benefit using this financial contract. Imagine you put $10,000 of annual premium into a permanent life insurance policy for ten years.

Your basis on this policy would be $100,000 ($10,000 x ten years). Let’s say that over the ten years the equity in the policy grew to $110,000 of cash value. Because permanent life insurance operates with a First-In First-Out principle, you could take the $100,000 (your basis) out of the policy without creating a taxable event.

You could also borrow virtually the whole amount as a loan, using the cash value as collateral. Of equal importance is that you can do so without disrupting the cash value growth, or the death benefit features of the policy.

Most insurers have very low net cost associated with borrowing cash values. But the most powerful features are the utility, liquidity and control you have over your money.

Tuesday, August 16, 2011

Need Life Insurance for your business???

When should life insurance be utilized for businesses and business owners?

When should life insurance be utilized for businesses and business owners?They write whole books about this, but let me list just a few areas where it may be appropriate.

Many businesses are sole proprietors or family owned. When the business negotiates a loan with the bank, the bank usually wants a personal guarantee of the owner to repay the loan. A life insurance policy on the owner in the amount of the loan can make sure that at the death of the owner, the loan can and will be repaid to the bank without undue financial strain on the business.

If your business has more than one owner, it would be good business practice to have a buy-sell or stock redemption plan in place. If one owner dies, the agreement specifies how the deceased owner’s share of the business will be purchased.

While this buyout could be spread out over a period of years, the cost to the business could be difficult to sustain if it adversely affects the companies cash flow. Life insurance, purchased at a minimal expense, may be a much more cost effective solution to funding the cash required for the payout. It also provides peace of mind the other owners and the deceased’s heirs knowing that they are assured of receiving the payout as specified in the agreement.

There are many more uses of life insurance for business, and we will discuss these in future blogs.

Sunday, August 14, 2011

From a mother to her son...

A Love Letter About Life Insurance

www.lifehappens.org

I recently ran across a yellowing sheet of paper with a typewritten letter; it was a copy of a note I had sent to my son. The date on the letter was Nov. 21, 1989, and my son, who is now in college, was just four months old at the time. As I read it again after 20 years, I realized something: Although I was telling him about the life insurance policy we had just purchased for him, it was, in fact, a love letter.

Love letter, you say? What has life insurance got to do with love? Well, quite a lot, it turns out. The bottom line is that you buy life insurance because you love people and want to protect them financially.

I may be biased because I work in the industry, but take a look at the letter to my son, and see if you don’t agree:

Dear J.P.:

Today is November 21, 1989, and possibly you are wondering what the date has to do with writing you this letter.

While you are only four months old at the present time, I hope that this is a date you will remember, because today we purchased for you a life insurance policy. It is one like we have and it will be for your use for the rest of your life.

J.P., the difference between financial success and failure is often determined by whether or not a person can discipline themselves in a consistent and conservative financial strategy. Life insurance is ideal in this respect because it has withstood the test of time both for family security and savings; it’s the greatest savings plan in the world because IT WORKS!

It may be that you will have to call upon the cash value of this policy many times during your lifetime and, at such time, we hope you will remember that we started this for your benefit.

This policy carries with it two features of particular significance. The first is an automatic purchase option, which will allow us to increase your coverage as you attain certain ages. The other feature is one that has been very meaningful to me in my financial life and it is called disability waiver of premium. This means that in the event you should ever become disabled, your financial plan will be self-completing for you and your family.

This policy is a special gift of love and affection from both your mother and me; and we suspect that it will be remembered long after all other gifts are forgotten.

May God’s blessings be with you always.

Love always,

Dad and Mom

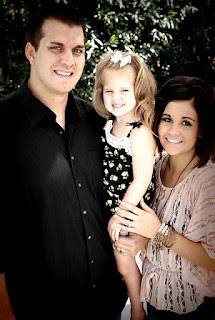

A Solid Foundation For Your Children

Gifts of a Lifetime (lifehappens.org)

I like to call them gifts of a lifetime. After I made sure my own financial plans were in order many years ago, I bought two small whole life policies for my two daughters. I recently carried the tradition on with my grandchildren.

Such insurance purchases are gaining some attention during these volatile economic times, notes Jilian Mincer in a recent Getting Personal column for Dow Jones Adviser, entitled “More People Buying Life Insurance For Children.”

Why the uptick? The reason is simple: a whole life policy that builds cash value is a way to provide a solid financial foundation for your children and/or grandchildren while simultaneously locking in life insurance coverage for their entire life. Buying whole life for my grandchildren allows me to expose them to one of many prudent options in someone’s financial toolkit. It is by no means their only financial tool, but it makes sense to use the living benefits that a protection product like whole life insurance offers. The cash value that accumulates in a whole life policy can be used for college tuition, a mortgage on a first home, or a nest egg for a grandchild’s own retirement. Importantly, it also provides a death benefit for their families if a tragedy should occur.

By securing policies for my grandchildren, my wife and I know that when we are no longer around, our grandchildren, and potentially even their children, will carry a little piece of us with them as they build their own financial future for their families. For a few dollars a month, I am leaving a legacy, and that’s a gift I will always be proud to give.

Ronald B. Lee, CLU, ChFC, CLTC, is a co-general agent of Lee Nolan Associates LLC, a general agency of the Massachusetts Mutual Life Insurance Company (MassMutual).

Subscribe to:

Comments (Atom)